Steelcase Inc. today reported second quarter revenue of $818.8 million and net income of $55.5 million, or diluted earnings of $0.47 per share, which included $15.6 million of pre-tax restructuring costs related to previously announced workforce reductions. Excluding those charges, net of related income tax benefits, adjusted earnings were $0.55 per share. In the prior year, Steelcase reported $998.0 million of revenue and net income of $60.5 million, or diluted earnings of $0.50 per share.

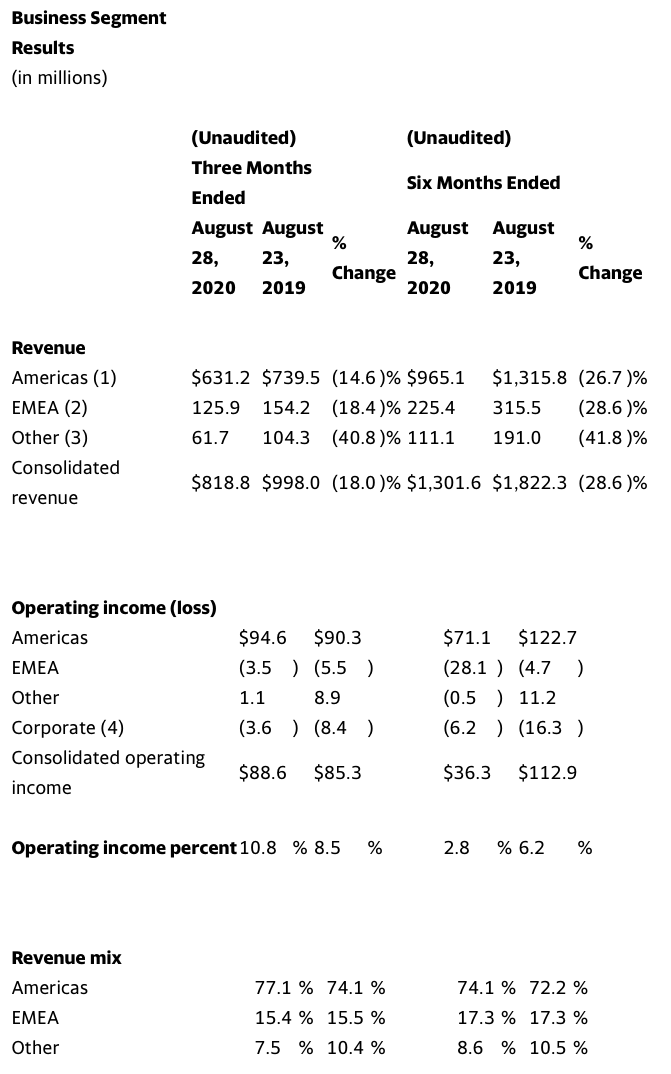

Revenue decreased 18 percent in the second quarter compared to the prior year. Revenue in the quarter benefited from a strong beginning backlog of customer orders, which exceeded the prior year by 11 percent due to pandemic-related restrictions on manufacturing and delivery activities during the first quarter. Revenue declined 15 percent in the Americas and 18 percent in EMEA compared to the prior year. Revenue in the Other category declined 41 percent, or 29 percent on an organic basis after adjusting for the impact of the PolyVision divestiture in February 2020 and currency translation effects.

“More bad news ahead. Going into the third quarter, orders declined an average of 38 percent during the first three weeks of September compared to the prior year, including declines of 41 percent in the Americas, 27 percent in EMEA, and 37 percent in the Other category.”

Orders (adjusted for the impact of the PolyVision divestiture and currency translation effects) declined 32 percent in the second quarter compared to the prior year, declining by 37 percent in June, 34 percent in July and 22 percent in August. For the quarter, orders declined 35 percent in the Americas, 22 percent in EMEA and 25 percent in the Other category compared to the prior year. In the Americas, the monthly year-over-year order declines improved through the quarter, as orders stabilized compared to more typical seasonality in the prior year, and project business and orders from smaller customers reflected lower declines than the overall average. In EMEA, performance varied significantly by geographic market based on the stage of the pandemic locally, and orders included a $19 million project in the education sector that is expected to ship in the third quarter. The Other category included an order decline of 18 percent in Asia Pacific, which included growth of 5 percent in China, compared to the prior year.

"I want to thank the employees of Steelcase for their resilience, sacrifice and hard work to fulfill our customer commitments and drive better than expected second quarter profitability as we worked through our backlog of orders and contained our costs," said Jim Keane, president and CEO. "Our year-over-year order decline rates have moderated for four consecutive months, but the continued high level of COVID cases in the Americas has delayed our customers' return to the office and suppressed demand levels. In EMEA and Asia Pacific, our order patterns have improved and our opportunity pipelines are increasing as many workers have returned to the office in those markets."

Second quarter operating income of $88.6 million included $15.6 million of restructuring costs related to the previously announced workforce reductions. Adjusted operating income of $104.2 million represented an increase of $18.9 million compared to operating income of $85.3 million in the prior year. The increase was driven by significant cost reduction actions implemented across all segments, which more than offset the impact of lower revenue. The Americas reported operating income of $94.6 million, and adjusted operating income of $110.2 million (17.4 percent of revenue), compared to operating income of $90.3 million (12.2 percent of revenue) in the prior year. EMEA reported an operating loss of $3.5 million compared to an operating loss of $5.5 million in the prior year. The Other category reported operating income of $1.1 million compared to $8.9 million in the prior year, which included $2.6 million from PolyVision.

Gross margin of 32.9 percent in the second quarter represented a 50 basis point decline compared to the prior year, with an 80 basis point decline attributable to restructuring costs. Gross margin improved in the Americas and declined in EMEA and the Other category. On a consolidated basis, the results were driven by the impact of the lower revenue and restructuring costs, partially offset by lower overhead costs including temporary reductions in pay for salaried employees, pricing benefits and lower variable compensation expense.

Operating expenses of $172.3 million in the second quarter represented a decrease of $75.9 million compared to the prior year. The decrease was primarily driven by an approximately $32 million reduction in discretionary spending, approximately $22 million of lower employee costs primarily related to temporary reductions in pay across most of the company's global salaried workforce and $9.2 million of lower variable compensation expense.

The restructuring costs relate to the workforce reductions announced on September 1, 2020, which the company estimates will result in savings of approximately $10 million per quarter. The company expects to record a total of approximately $26 million of restructuring costs related to the actions, of which $15.6 million was recorded during the second quarter and the remainder is expected to be recorded in the third quarter. The company has restored most of its salaried workers to their full base pay, which it estimates will result in approximately $20 million of additional costs in the third quarter as compared to the second quarter.

“The strength of our second quarter results and the recent improvements in demand patterns in EMEA and Asia Pacific influenced our decision to restore salaries for most of our global workforce,” said Dave Sylvester, senior vice president and CFO. “While we have seen some recent improvement in the rate of decline in our year-over-year order patterns in the Americas, day-to-day business and project pipelines remain depressed due to the ongoing economic uncertainty and the high number of customers deferring their return to the office. Accordingly, we decided to make more permanent changes to our cost structure through workforce reductions, which will lower our annualized costs by approximately $40 million."

Investment income of $0.2 million in the second quarter represented a decrease of $1.3 million compared to the prior year due to lower market interest rates. Other income, net decreased by $1.2 million compared to the prior year, due primarily to lower income from unconsolidated affiliates.

The company recorded income tax expense of $27.3 million in the second quarter, which represented an effective tax rate of approximately 33 percent. In the prior year, income tax expense was $21.6 million and represented an effective tax rate of approximately 26 percent.

Total liquidity, comprised of cash, cash equivalents and the cash surrender value of company-owned life insurance, aggregated to $683.7 million.

Total debt was $483.3 million at the end of the second quarter. During the quarter, the company repaid all outstanding borrowings under its global credit facility.

“Our strong earnings and working capital management drove a 22 percent increase in cash flow from operations and we reduced our capital expenditures by approximately 50 percent compared to the prior year,” said Dave Sylvester. “Based on the strength of our cash generation during the quarter, we chose to repay all of the $245 million in remaining borrowings under our credit facility which we had drawn as a precaution earlier in the year. We ended the quarter with $684 million of liquidity which supports our ability to stay invested in new solutions to drive growth in the changing workplace.”

The Board of Directors has declared a quarterly cash dividend of $0.10 per share, to be paid on or before October 15, 2020, to shareholders of record as of October 2, 2020.

Outlook

At the end of the second quarter, the company’s backlog of customer orders was $577 million, or 8 percent lower than the prior year. Going into the third quarter, orders declined an average of 38 percent during the first three weeks of September compared to the prior year, including declines of 41 percent in the Americas, 27 percent in EMEA, and 37 percent in the Other category. As a result, the company expects third quarter fiscal 2021 revenue to be in the range of $690 to $725 million. The company reported revenue of $955.2 million in the third quarter of fiscal 2020. Adjusted for the divestiture of PolyVision and currency translation effects, the projected revenue range translates to an expected organic decline of 24 to 27 percent compared to the third quarter of fiscal 2020. The year-over-year comparison also reflects the impact of the timing of the U.S. Thanksgiving holiday which will fall in the third quarter of fiscal 2021 compared to the fourth quarter of fiscal 2020.

The company expects to report diluted earnings per share of between $0.07 to $0.13 for the third quarter of fiscal 2021. This estimate includes $0.05 per share of estimated restructuring costs, net of tax related to the previously announced actions. Adjusted for the estimated restructuring costs, the company expects to report adjusted earnings of between $0.12 to $0.18 per share. The estimate also reflects: (1) projected operating expenses of between $180 million to $185 million, (2) projected interest expense, net of investment income and other income, net of approximately $5 million and (3) an expected effective tax rate of approximately 25 percent (or approximately 30 percent when adjusted for the estimated restructuring costs and the related tax benefit). Steelcase reported diluted earnings per share of $0.46 in the third quarter of fiscal 2020.

“As the number of COVID cases declined in Asia Pacific and EMEA, we saw a strong return to the office in those regions as companies utilize the workplace to drive higher productivity, increase collaboration and promote their culture," said Jim Keane. “As progress is being made in the U.S. relative to the pandemic, we expect to see momentum build to bring employees back to work which will drive improved demand for our solutions to provide a better experience.”

Business Segment Footnotes

The Americas segment serves customers in the U.S., Canada, the Caribbean Islands and Latin America with a portfolio of integrated architecture, furniture and technology products marketed to corporate, government, healthcare, education and retail customers through the Steelcase, Coalesse, Turnstone, Smith System, AMQ and Orangebox brands.

The EMEA segment serves customers in Europe, the Middle East and Africa primarily under the Steelcase, Orangebox and Coalesse brands, with an emphasis on freestanding furniture systems, storage and seating solutions.

The Other category includes Asia Pacific and Designtex. In 2020, the Other category also included PolyVision, which was sold in February 2020.

Corporate costs include unallocated portions of shared service functions, such as information technology, corporate facilities, finance, human resources, research, legal and customer aviation, plus deferred compensation expense and income or losses associated with company-owned life insurance.