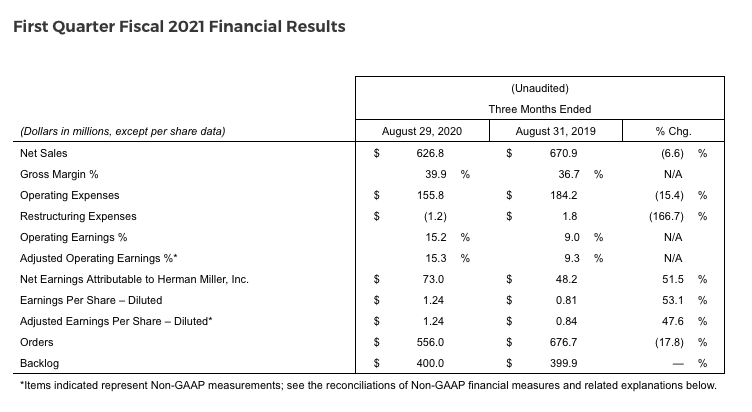

Herman Miller reported that consolidated net sales for the quarter were down by 7% compared to last year and down 13% organically, which excludes the impacts of acquisitions and foreign currency translation. Our net sales this quarter benefited from the elevated backlog levels we reported at the start of the period, which were driven in part by the impact of manufacturing and project scheduling disruptions experienced during the fourth quarter of last fiscal year. Orders in the quarter were down 18% compared to the prior year on a reported basis and down 24% organically.

Retail Segment

Our Retail business led the way this quarter, with orders up an impressive 40% over last year. Demand was led by the Home Office category, which increased nearly 300% over last year. Consumers are also investing in their broader home environments, which led to positive year-on-year demand across multiple product categories, notably Upholstery, Outdoor, and Accessories.

North America Contract Segment

The North America segment continued to feel the effects of COVID-19 on overall demand levels, posting a year-over-year decline of 40%. With that said, we were encouraged to see modest improvement in order trends within this segment in the back half of the quarter.

International Contract Segment

Our International segment saw a relatively improved demand environment as regions such as Asia-Pacific and Europe are further ahead on the recovery path from the effects of COVID-19. Orders were up 26% on a reported basis and down 9% organically. Our recent HAY acquisition was a particularly strong contributor within the International business with order levels that were 3% higher than last year as HAY's mix of consumer and contract business helped drive demand.

Operating margins for the quarter were 15.2%, reflecting a meaningful improvement over 9.0% reported in the same quarter last year. There were two primary drivers of these strong results. Gross margins of 39.9%, which were 320 basis points higher than last year, reflected strong channel and product mix and high productivity from our manufacturing teams. At the same time, we continued to take decisive actions to manage expense levels, with operating expenses down $31.4 million from last year.

As a result of our strong operating performance, we delivered earnings per share of $1.24 on both a reported and adjusted basis for the quarter, which reflected a year-over-year increase of 53.1% on a reported basis and 47.6% on an adjusted basis.

We also continued to maintain a strong and flexible balance sheet, with combined liquidity from cash on hand and availability on our revolving credit facility of $562.3 million at the end of the quarter. This represented an increase of $107.7 million from the fourth quarter of last fiscal year and was aided by robust cash flow from operations during the quarter of $115.9 million. At the same time, our gross-debt to EBITDA ratio of 1.1x is well below the maximum level of 3.5x required by our bank covenants.

Re-Establishing Quarterly Dividend

Based on our confidence in the strategic direction of the business, strong liquidity position and operating performance this quarter, we are re-establishing a quarterly cash dividend program. Indicating their shared sense of confidence in our business, our Board of Directors approved a $0.1875 per share dividend that will be paid on January 15, 2021 to shareholders of record as of November 28, 2020.

Looking to the Future, Guided by Purpose

The global pandemic validated what we already knew–we are better together, as a comprehensive family of brands capable of meeting the needs of customers wherever they live, work, learn, heal or play. Today, we are more unified than at any point in our company history, with a shared purpose that defines our reason for existing: "Design for the good of humankind." Guided by this purpose, we enter this next era in our history assured that Herman Miller Group will continue to create places that matter for our customers while also helping to build a better world.

To realize this purpose, our strategy centers around four key pillars:

Unlock the power of One Herman Miller to fully leverage our portfolio of brands and capabilities

Build a customer-centric, digitally enabled business model in both the Contract and Retail markets

Accelerate profitable growth in each of our business segments

Reinforce our commitment to our people, places and communities

Even as we navigate the challenges brought on by COVID-19, we have not lost focus on these strategic priorities, and we made important progress on many fronts during the first quarter of fiscal year 2021, including:

A Digital Imperative

Nearly two years ago we set out to design a technology infrastructure that would support our goal of becoming a digitally enabled business capable of delivering frictionless customer experiences. Our investments in this area allowed us to pivot quickly and capitalize on a new set of opportunities when our customers' purchasing behaviors changed rapidly due to the global pandemic.

E-commerce drove a significant portion of our Retail growth in the quarter, with overall web sales and orders up 248% and 257%, respectively, across our Herman Miller, DWR, and HAY websites in North America when compared to the prior year. We introduced several new capabilities in the quarter that further improve the customer experience and strengthen our position as a digital retailer:

We launched our reimagined Design Within Reach website in July, which has delivered on one of our objectives of improving conversion rates. The new platform will be the model for future refreshes of both the Herman Miller and HAY websites.

We created a Work from Home landing page on Herman Miller's website to help customers more easily browse and select the home office products that best meet their needs.

We developed a Work from Home online assessment tool that has been used by more than 12,000 customers to assess their needs. Data from this tool will also inform future investments and strategies for growing the home office furnishings category.

We have also made tremendous progress on improving our digital capabilities and solutions in support of our Contract business. Investments in this category are centered around reducing the complexity of the digital tool sets our dealers utilize and driving greater share of dealer spend to Herman Miller Group products and solutions.

Our new digital platform that helps Contract customers and design partners visualize, search and select from products across the dealer offerings has seen widespread adoption and is driving increased specification of Herman Miller Group products and solutions.

Excitement continues to build around our proprietary generative design technology that uses artificial intelligence to create dynamic floor plans populated with Herman Miller Group product. While still in beta testing, we believe this has the potential to be one of the most disruptive technologies the industry has seen in decades. A broader North America release is planned for late in calendar year 2020.

The Office of the Future

In the future, hybrid working models are expected to become the norm. Offices will become destinations, and we are well-positioned to partner with our customers to design innovative workplace solutions that serve as collaboration centers and solve for the geographic dispersion of the office footprint. At the same time, the demand for home office products continues to expand our addressable market. Already, we have been able to capitalize on the near-term needs of our corporate customers by quickly expanding our Inside Access program to provide home office solutions for their employees who are now working remotely. Inside Access offers individuals the opportunity to purchase product as part of their employer's relationship with Herman Miller Group while leveraging our retail fulfillment capabilities.

A Differentiated Retail Opportunity

The Retail business delivered the best quarterly sales and profitability in the history of this business. While a large portion of this exceptional first quarter was fueled by demand for home office solutions, our Retail business posted growth across several important product categories as our strategy is clearly resonating with consumers. Through the warm weather months, orders in the Outdoor category grew 51% over the first quarter of last year. Orders within our line of Accessories grew 34% as consumers looked to make inexpensive upgrades to their homes, particularly in the categories of kitchen and storage products. Lastly, the Upholstery category grew 25% over last year, supported by increasing consumer demand for furnishing upgrades that enhance the comfort and functionality of their living spaces. The strength of our e-commerce channels was a clear bright spot this quarter, but we were also particularly pleased with the performance of our full-price brick-and-mortar retail locations, where demand levels were up approximately 4% compared to last year despite a decline in overall traffic levels. We believe we have only scratched the surface of the opportunity in this segment and we will continue to invest in, grow, and transform our Retail business going forward.

Our eagerly anticipated entry into the gaming market, in partnership with Logitech G, came to reality in the quarter (https://www.hermanmiller.com/products/gaming/). In the month following launch, global demand for the Embody® Gaming Chair significantly outpaced our expectations. Our strategy to engage influencers and leverage social media generated more than 243 million social media impressions in just the first two days after launch. We are still in the early days of reaching this new audience, with a series of gaming specific product introductions planned for the coming months, including the recently released Matte Black Special Edition Aeron® Gaming Chair.

Gaming was one of the first ideas to emerge from our Innovation Incubation team – a stand-alone function responsible for identifying emergent and disruptive concepts that can further drive growth across Herman Miller Group. While we are thrilled with the early success of our entry into gaming, we are equally excited to see what comes next from this innovation pipeline, including our new performance seating and home office retail concept stores. These stores will offer customers the opportunity to explore Herman Miller's home office solutions firsthand, which we know from customer research is a preference for these types of highly considered purchases. We plan to open the first of these concept stores later this fall.

Contributing to a Better World

Like many other organizations, we are speaking out against the racism and oppression that have persisted in the US–and around the world–for generations. While we've long believed in the importance of diversity and inclusion in our workplace, we are more committed than ever to creating an equitable environment within our company, across our industry, and everywhere we live and work. Andi Owen recently joined more than 1,200 CEOs in signing the CEO Action for Diversity & Inclusion™ Pledge and we have shared the details of our diversity, inclusion, and equity commitments on the "Taking Action Toward Equity" page of our website (https://www.hermanmiller.com/our-values/inclusiveness-and-diversity/taking-action-toward-equity/). Meaningful change begins at home and we will continue to hold ourselves accountable in the pursuit of social justice.

Outlook

While encouraged by our strategic progress, we are continuing to suspend sales and earnings guidance given the uncertain demand environment in the face of the persisting global pandemic. Despite not offering guidance, there are certain demand indicators that we believe are relevant for investors developing revenue estimates for our business in the upcoming quarter. Recent demand patterns and backlog are the most relevant data points to estimate near-term revenue opportunities. As noted earlier, orders in the first quarter at the consolidated level were down 18% from the same period last year and, through the first two weeks of the second quarter, consolidated orders were down 10%. The backlog at the end of the quarter was flat with last year. On the profitability front, we continue to expect operating income deleverage in the range of 25% to 30% over time. While this will not necessarily be an even walk from quarter to quarter, we would expect this outcome over time if we experience a recessionary period of similar depth and duration to the past two recessions.