CALGARY, ALBERTA--(May 4, 2016) - DIRTT Environmental Solutions Ltd. today announced its financial results for the three-month period ended March 31, 2016. This news release contains references to Canadian dollars and United States dollars. Canadian dollars are referred to as "$" and United States dollars are referred to as "US$".

Selected Highlights

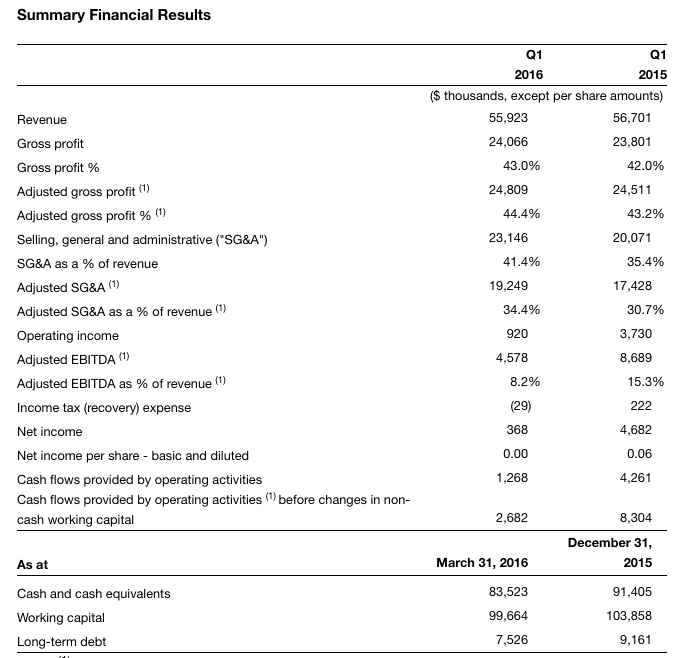

For the three months ended March 31, 2016 the Company reported:

- Significant non-energy revenue growth in the quarter of 27.3%;

- Trailing 12-month revenue was $235.8 million versus $203.5 million in the prior 12-month period, an increase of 15.9%;

- Adjusted gross profit (see "Non-IFRS Measures") increased by $0.3 million to $24.8 million, or 1.2%, over Q1 2015;

- Adjusted gross profit % (see "Non-IFRS Measures") increased by 120 basis points from 43.2% to 44.4% over Q1 2015;

- Continued and expanded investment in sales, marketing and business development contributing to Adjusted SG&A as a percentage of revenue (see "Non-IFRS Measures") of 34.4%; and

- Adjusted EBITDA (see "Non-IFRS Measures") for the quarter and trailing 12 months of $4.6 million and $27.7 million, respectively.

"In 2015 we could see challenges on the horizon for the energy industry and in response we proactively increased our sales efforts and investments across North America and all industry sectors," said Mogens Smed, CEO of DIRTT. "As a direct result, we reported non-energy sector revenue growth of 27.3% over the first quarter of 2015."

"While we remain focused on diversifying and building our core North American business we were also pleased to see an 83% increase in our international business to $4.2 million in the quarter," said Scott Jenkins, President. "We have increased our sales and marketing-related team by 14.4% from the prior year and will continue to make further strategic investments to drive growth."

"Favorable project mix and relatively stable manufacturing volume helped us to generate improved gross profit over the prior year period, in conjunction with a more favorable average US-Canadian exchange rate in this year's quarter," said Derek Payne, CFO of DIRTT. "Alongside better industry fundamentals, we saw stronger sales momentum as we exited the quarter and we expect stronger year-over-year results for the second quarter."

Revenue

Revenue decreased by $0.8 million, or 1.4%, for Q1 2016 compared with Q1 2015. Q1 2015 revenue included $8.1 million from the previously announced US$30.0 million US energy sector contract compared to nil in Q1 2016. This business was partially offset by a general increase in activity from small and medium-sized projects in the current year period from a diverse range of industry segments. While total volume decreased quarter over quarter, the stronger US dollar versus the comparable period in 2015 increased the Canadian dollar value of US revenue, largely offsetting the decline in volume. Sales to the energy sector accounted for 9% of total revenue in Q1 2016, down from 28% of total revenue in Q1 2015. This decline was largely offset by increases in revenue from almost all other sectors.

Adjusted Gross Profit

Adjusted gross profit for Q1 2016 improved slightly to $24.8 million from $24.5 million for Q1 2015, with adjusted gross profit % widening 120 basis points to 44.4% from 43.2%. Relatively steady manufacturing volumes throughout Q1 2016, combined with a diverse project mix, contributed to the increase in adjusted gross profit % in Q1 2016. The higher US dollar to Canadian dollar exchange rate also contributed to increased adjusted gross profit in Q1 2016, as the positive impact on US dollar revenue exceeded the negative impact on US dollar-based production costs.

Adjusted SG&A Expenses

Adjusted SG&A as a percentage of revenue increased by 370 basis points from 30.7% to 34.4% in Q1 2016 compared with Q1 2015. Adjusted SG&A expenses increased by $1.8 million, or 10.4%, for Q1 2016 compared with Q1 2015. The increase reflects DIRTT's ongoing investment in long-term growth. The most significant changes can be attributed directly to marketing-related efforts including travel, people and promotional build-outs to showcase our capabilities.

The higher US dollar to Canadian dollar exchange rate also contributed to the overall increase in adjusted SG&A expenses across the organization for Q1 2016, as certain of these expenditures are denominated in US dollars.

Adjusted EBITDA

Adjusted EBITDA decreased by $4.1 million, or 47.3%, for Q1 2016 compared with Q1 2015. Adjusted EBITDA as a percentage of revenue for Q1 2016 weakened by 710 basis points from 15.3% to 8.2% in Q1 2015. A large portion of the decrease was related to the increase in foreign exchange loss of $2.6 million in Q1 2016 as a result of significant fluctuations in foreign exchange rates which impacted the translation of US dollar denominated balances and day-to-day transactions. The remainder of the decrease in Q1 2016 came from higher adjusted SG&A expenses of $1.8 million, partially offset by the improvement in adjusted gross profit of $0.3 million.

Outlook

Our growth strategy consists of five key initiatives: (1) increasing penetration of existing markets by providing continued support and increased investment to our existing DPs throughout North America; (2) expanding into new geographies, such as the Middle East and United Kingdom, by capitalizing on recent and continued investment alongside new international DPs; (3) penetrating new vertical markets such as the healthcare, education and residential sectors; (4) continuing to invest in ICE and new innovative interior construction solutions such as the Enzo Approach, residential interiors and timber frame construction; and (5) partnering with industry leaders to monetize innovative solutions.

With the recent launch of our residential and timber frame solutions, we have officially entered into these markets. We do not expect to see meaningful revenue from these markets in the near term; however, we were pleased to announce the award of our first significant residential contract for 16 duplexes in Alaska.

We believe DIRTT Solutions are a superior alternative to conventional construction in all sectors of the construction industry, and that a continued increase in construction activity can be expected to result in an ongoing improvement in our revenue. We plan to invest additional resources, including the further development of ICE and the development of new DIRTT Solutions and test projects, to pursue further opportunities in healthcare, education, government and residential sectors of the construction industry.

The American Institute of Architects' (AIA) Architecture Billings Index (ABI) can be a useful leading economic indicator of how US non-residential billing activity could trend. The most recent March billings and design activity numbers continued to show growth nationally, building on an improving trend in February following a slower start to the year. Regionally, the Northeast, South and West all saw billings grow with the Midwest remaining essentially flat. Both DIRTT and the AIA believe these overall numbers still point to solid fundamentals that could support growth across all segments of the building industry for the next nine to 12 months.

A major component of DIRTT's ongoing marketing activities is DIRTT Connext™, our annual sales, marketing and training initiative which occurs every June in Chicago. It coincides with NeoCon®, North America's largest commercial interiors exposition which typically attracts 50,000 design professionals. Each year DIRTT transforms its company-owned Chicago GLC to showcase its newest innovations and construction solutions to the architect and design community, clients, investors and the media. Distribution Partners and DIRTT sales representatives also take part in comprehensive training sessions, hear from DIRTT's leadership team and key third parties, and network with colleagues - all to strengthen their ability to succeed in their local markets.

The total cost for DIRTT Connext in 2015 was $2.3 million. As the tangible benefits of this yearly event continue to become more evident, we expect to increase our investment in DIRTT Connext. This year's cost will be higher as we ramp up our investment in ongoing support and development of the broader team, more of our Distribution Partners and sales representatives participate, and the number of tours for our Distribution Partners' out-of-town clients continues to increase. Along with our investment, our Distribution Partners incur their own travel costs - in some cases bringing their entire teams to leverage the training and selling opportunity.

While these expenses are primarily incurred in Q2, DIRTT Connext's comprehensive sales and marketing initiatives significantly enhance regular marketing, training and communications efforts throughout the remainder of the year and beyond.

Liquidity and Capital Resources

At March 31, 2016, we had $83.5 million in cash and cash equivalents compared with $91.4 million at December 31, 2015. At March 31, 2016, we also had access to an undrawn US$18.0 million revolving credit facility. In March 2016, we signed a fourth amendment to the amended and restated loan agreement with our lenders, which among other things, provided us with an additional capital financing facility of US$10.0 million, which was undrawn as at March 31, 2016.